When can I retire? It is a top question we receive as financial advisors. The answer may be different for federal employees than those working for a public or private company. The federal government provides…

Read MoreHow Do I Retire with FERS Benefits From My Federal Job?

Thinking about retiring from the federal government? It can be a complex process, with several pathways, depending on your career and personal circumstances. With the right information and preparation, you can navigate it smoothly so…

Read MoreHow Mindful Spending Can Help You Save Money When Costs Are Going Up

The cost of living continues to increase, and families are taking a hard look at their budget as everyday basics like groceries now cost significantly more. Purchasing power has also been limited if you’re in…

Read MoreThinking About Federal Retirement? Plan Early So You Don’t Miss Benefits

Retiring from the federal government provides employees with valuable benefits, but retirement is more complicated than leaving a private employer. Federal retirement planning should start early, even five years out, so you don’t miss benefits….

Read MoreMaximize Your Federal Retirement Benefits: Check Your Official Personnel Folder For These Things

When your long-awaited retirement day approaches, you want it to be everything you’ve dreamed of and worked for financially. But, for federal employees, one file/folder can cause you a headache as you approach federal retirement….

Read More34 Questions Federal Employees Should Ask About the Thrift Savings Plan

Whether you’re new to a government job or have been a federal employee your entire career, understanding how the Thrift Savings Plan works can help you maximize returns and build wealth on your way to…

Read MoreMarketWatch Quotes Todd Minear on Dow Tumbling

MarketWatch quoted Todd Minear of Open Road Wealth Management about the Dow tumbling below 30,000, in the article – Too scared to check your 401(k) as Dow tumbles below 30,000? Too worried to peek at…

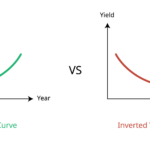

Read MoreInverted Yield Curve: What Does It Mean [VIDEO]

Have you heard about an inverted yield curve? It gets a lot of attention because of what it often predicts. However, let’s talk about what it means and how to react as an investor. What…

Read MoreMarket Volatility: How To Emotionally Prepare [VIDEO]

There’s a lot of fear and uncertainty leading to market volatility. The Federal Reserve raised rates, Russia invaded Ukraine, and inflation is skyrocketing, increasing consumer costs. Preparing for market volatility The market is up and…

Read MoreUnknowns and Fear in the Marketplace: How To React As An Investor [VIDEO]

There are a lot of fears and unknowns in the marketplace with the war between Russia and Ukraine, and the Federal Reserve moves. A question I often hear is – what are they going to…

Read More