Have you heard about an inverted yield curve? It gets a lot of attention because of what it often predicts. However, let’s talk about what it means and how to react as an investor.

What is an inverted yield curve?

The Treasury yield curve is a chart that shows yields, also known as interest rates of bonds, on one side and time to maturity on the other axis. So, it’s the plotting of interest rates over time.

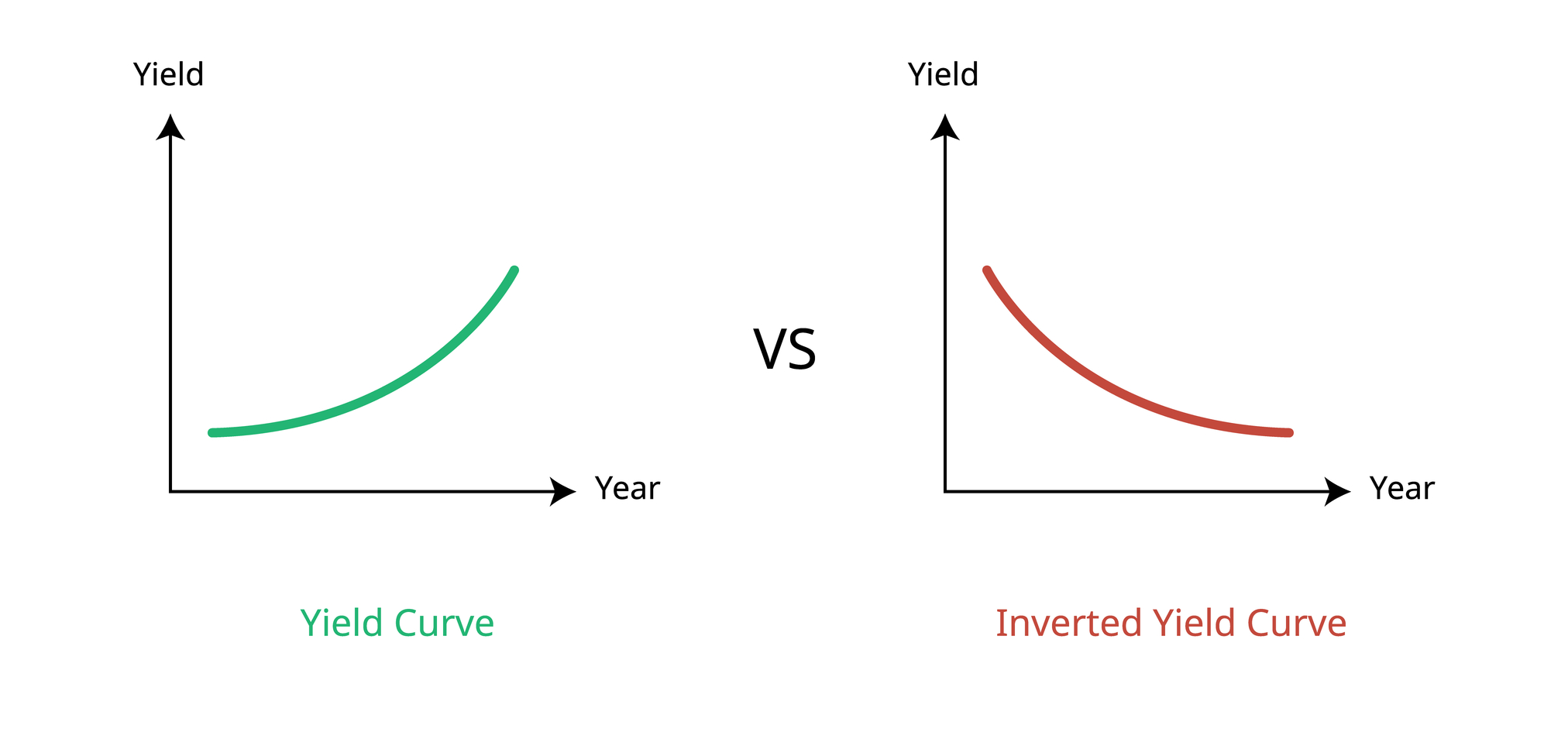

Look at the difference between a normal yield and an inverted one.

A normal yield goes up with time.

When it’s inverted, the yield goes down with time. That means long-term interest rates are lower than short-term interest rates.

Think about what’s going on right now in the economy. We have inflation. The cost of almost everything has gone up. You’ve probably noticed it with your daily expenses, like your food budget.

Housing costs are up, and interest rates are high. So, the real estate market has slowed.

Yield Curve 2 to 10 years

The most watched section of the yield curve is from 2 to 10 years.

In the video, Todd Minear shows you that the yield is relatively flat compared to the diagrams above. In December 2022, it started dipping. That’s what’s catching all the attention.

“Recently, though, the 10-year rate closed below the two-year rate, so it's mathematically inverted,” Minear explained.

What does it mean?

An inverted yield curve gets a lot of attention, because it’s predicted past recessions with a high level of confidence.

“So, does that mean a recession is coming? Maybe, maybe not,” explained Todd Minear. “So usually, it takes an amount of time for this to stay inverted before we see the recession.”

Don't panic. Recessions happen 7 to 35 months after a yield curve inversion. So, this is what the press is talking about this inverted part here from two year to 10 year. So what are we going to be doing?

Labor Market

We're also going to be looking at other economic indicators. One of the biggest things we're going to be looking at is the labor market. We're also going to be looking at consumer sentiment and we're going to keep an eye on what the Fed does. So we're keeping an eye on the potential of a recession.

Remember, you’re a long-term investor.

We’re always available at Open Road Wealth Management if you have any questions.